Fostering Fintech Growth: Effectus Software the Ideal Partner

You’ve probably already heard about the Fintech niche. It’s an ever-growing industry! Here you’ll find some current data to check growth.

Fintech is the intersection between finance and software. Therefore, creating new ground for both areas to meet, create, design and execute.

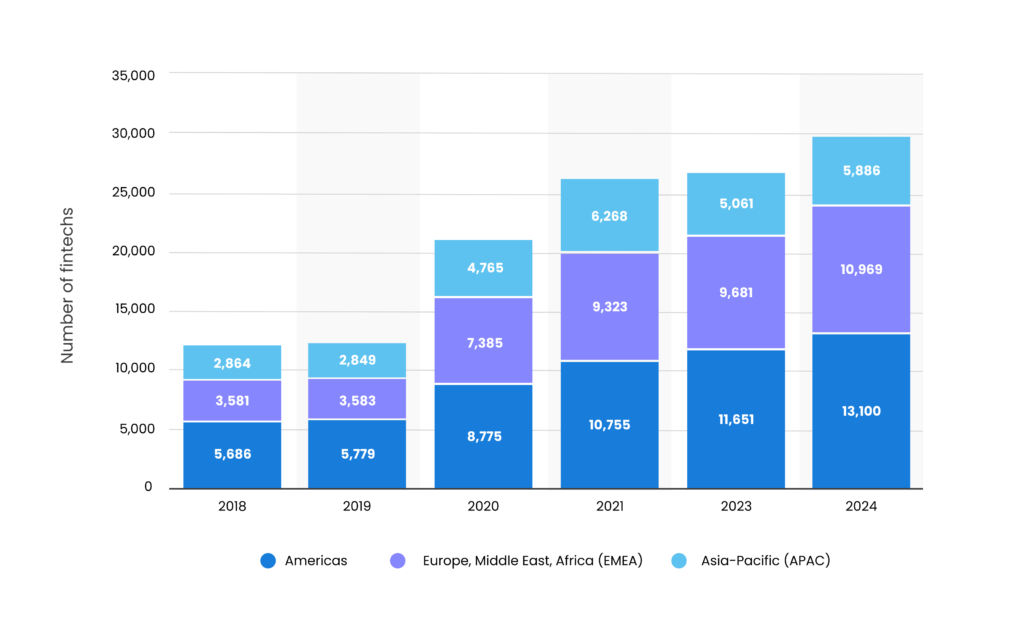

Number of fintechs worldwide from 2018 to 2024, by region.

So, fintech services are without any doubt part of everyones life, with more and more fintechs emerging every year.

Even though, lots of fintech companies stem from the United States and China by January 2024. South America has also taken a leading role in that area.

Fintech in use

If you’ve used Splitwise with friends to split a dinner check, bought cryptocurrency, make healthcare service, and the like; you’ve upped-the-game with fintech to work for you.

They have radically and quickly become part of our every-day life, we used them on a daily basis and people in general deem them as extremely useful tools.

As an example, we can show some data:

- The percentage of US consumers soared from 58% in 2020 to 80% in 2022.

- It cooled off in usage from 2021 to 2022, but fintech is now the most widely adopted consumer technology.

Fintech and Benefits

The soar in financial technology is changing the game in our financial world. Money is easier to access, and there is more flow people can do.

Fintech brings ways to share, save, invest, and manage money—making the money-flow better for the people. Even providing access to the ones who cannot access in regular conditions.

Its broad adoption, clearly shows that fintech is here to stay. And the Americas got a lot to offer.

Uruguayan fintech world is growing and becoming a steady niche within a beneficial tax system, leveraged by a long history as a financial strategic partner.

And, as Effectus does, surrounded by companies dedicated to developing cutting-edge solutions.

Representatives from Ripio, Mercado Pago, Prometeo, Regum, and Interbaking, investors from funds such as Incapital or Roble Capital, and authorities from the Central Bank of Uruguay participated.

Uruguay was positioned as a business and innovation hub, and the investment, export, and country image promotion agency is part of Uruguay XXI.

The Uruguayan fintech ecosystem has positive characteristics for the sector’s development:

- Uruguay’s good reputation as a financial center in the region

- Adequate qualification of human resources in the ICT and economic sectors

- A coordinated institutional system

The Ecosystem

Payment chains are covering circa 60 fintech companies in Uruguay, open banking or open finance, crypto, loans, trading platforms (alternative investment vehicles), etc.

The creation of fintechs has been exponential. We have been growing in the rate of affiliates between 20% and 30% per month.

We quote:

‘On a different note, investment in Uruguayan fintech companies is also booming, and a study carried out by the Uruguayan Association of Private Equity (URUCAP) together with the Ferrer study revealed that 20% of the investment operations carried out in Uruguay are in fintech companies.’

Now it’s time to talk about Effectus experience in Fintech projects. We’ve selected a few to explore and show the quality and potential of working together.

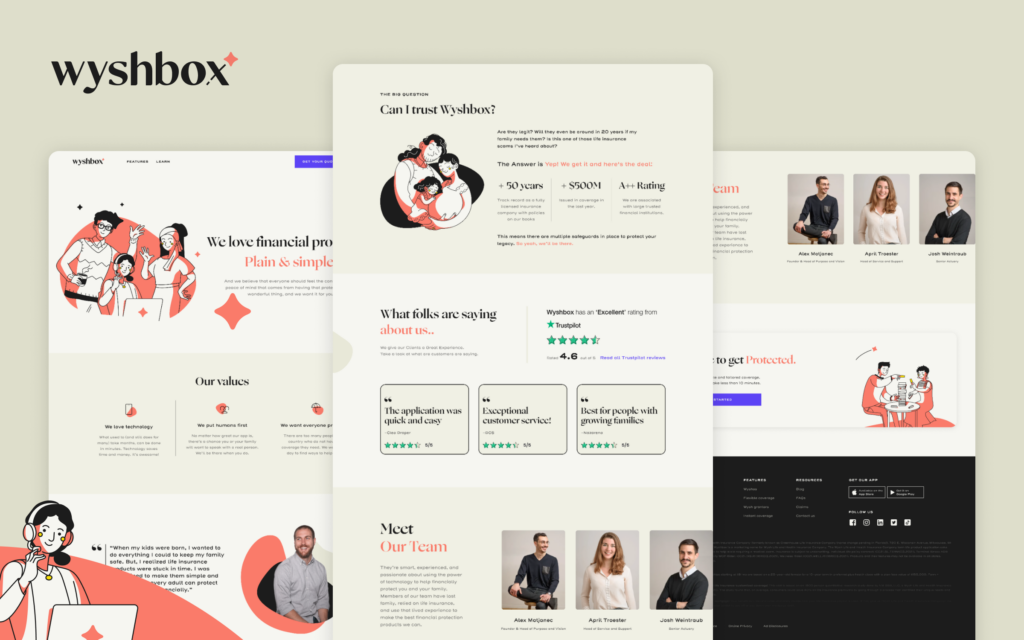

String & Key

It creates the technology that changes how we manage and protect our money.

As a product, they offer Wysh, a service for businesses to attract, retain and differentiate deposits. And for individuals you can secure your future with a life insurance.

As part of the process, we took and still take part in the product design with our top-notch designers and with our engineer team. Particularly when it comes to Ruby on Rails and React.js.

You might be wondering about design, well… here you’ll find examples to dig in:

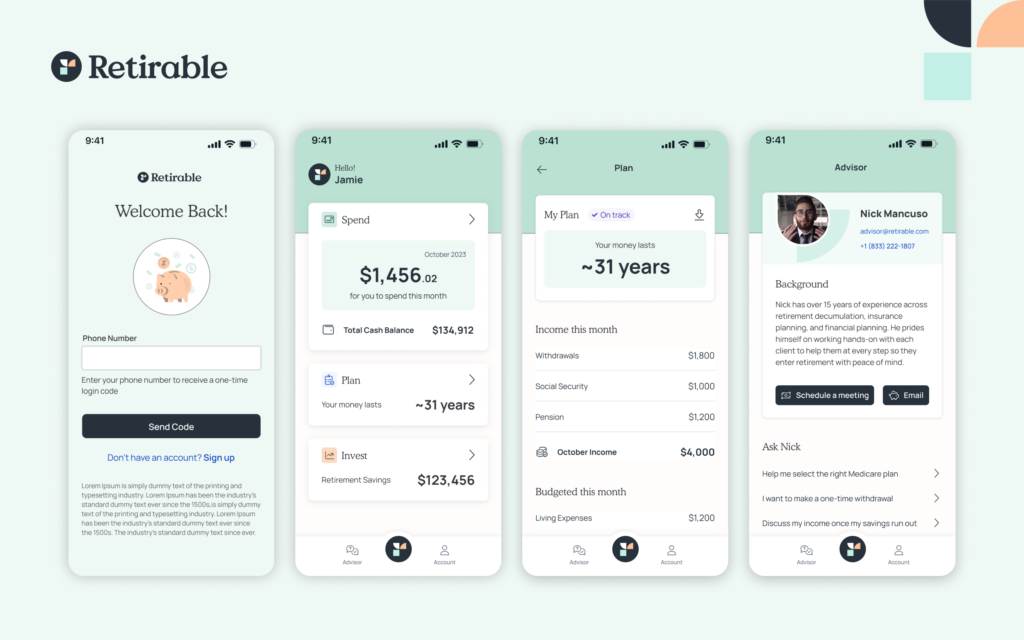

Retirable

Retirable is on a mission to create financial stability for every retiree.

By rethinking how to provide everyone with financial guidance for retirement, we can give them greater control and peace of mind when they need it most.

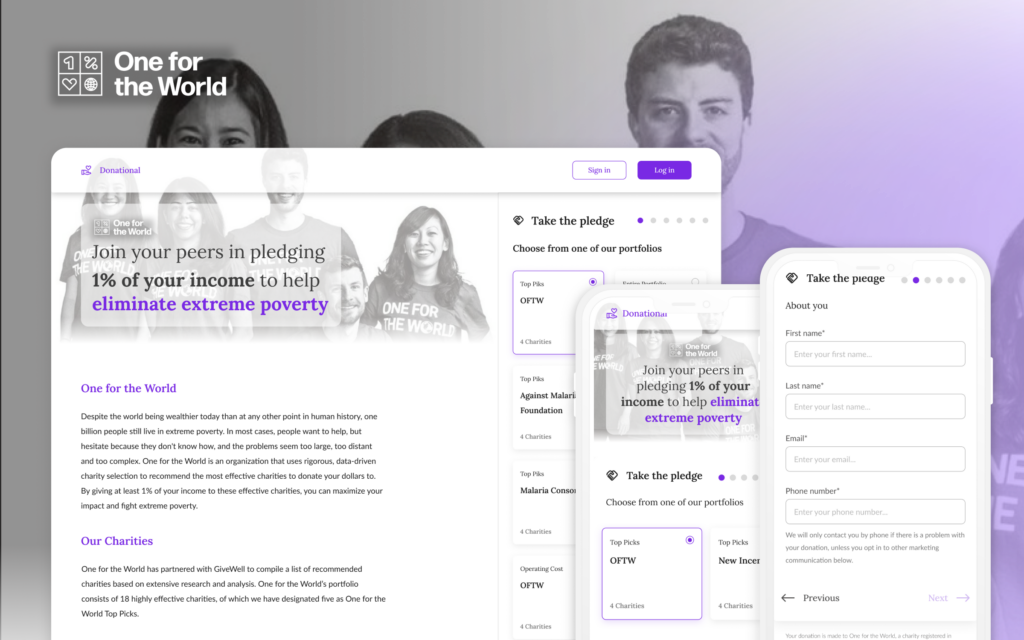

Donational

Donational is a platform for making donations built with Ruby on Rails. It allows people to generate a portfolio of donations to be made either one time or on a monthly basis.

It also targets students that want to donate once they graduate. The donations are made through credit cards by integrating the platform with Stripe.

Clients are from multiple parts of the world, so multi-currency is supported.

Let’s Round Up

As the industry continues to flourish in Uruguay, Effectus Software stands at the forefront, driving innovation and excellence in software development.

Our deep understanding of the unique needs of Fintech companies, combined with our commitment to delivering high-quality, customized solutions, positions us as a key player in this dynamic sector.

At Effectus Software, we pride ourselves on our ability to merge cutting-edge technology with industry expertise to create robust, scalable, and secure applications.

Our team of dedicated professionals is passionate about pushing the boundaries of what’s possible in Fintech, ensuring our clients can offer their customers unparalleled experiences and services.

We look forward to continuing our journey of growth and innovation, empowering companies in Uruguay and beyond to reach new heights.

With Effectus Software as your development partner, the future is bright, secure, and full of possibilities.